Subject: Program Income

Issue 2

Effective 12/26/2014

Posted 02/02/2018

Purpose of Guidelines

The University of Maine System receives program income generated from sponsored projects funded by Federal and State agencies, private and non-profit foundations, organizations, and industries. These guidelines explain administrative requirements and financial procedures for maintaining compliance with government and other regulations regarding program income.

Failure to follow these guidelines may have serious consequences, including disallowed costs, which would require reimbursement to the sponsor from unrestricted departmental funds; increased Federal oversight, monitoring, and audits; and loss of future Federal funding.

Policy

Program income related to projects financed in whole or in part with Federal funds shall be administered in accordance with standards set forth in the Office of Management and Budget (OMB) Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (“Uniform Guidance”) located in 2 CFR Part 200, SUBPART D – Post Federal Award Requirements, § 200.307 – Program Income.

Program income earned on non-Federal awards must be administered according to the terms and conditions of the award.

Who is Responsible

Responsibility for following program income guidelines lies primarily with Project Investigators and Project Directors, their Department Chairs or other direct supervisors, and unit-level fiscal personnel with general guidance and oversight of the colleges, schools and divisions.

Applicable University Sponsored Programs Office or other designated personnel are responsible for providing general guidance and technical assistance.

The University of Maine System administration is responsible for providing guidance through administrative practice letters and coordinating compliance monitoring through periodic internal and external audits.

Responsibilities and Procedures

A. Definition of Program Income

Program income is gross income that is directly generated by a sponsored activity or earned as a result of a sponsored activity. Program income includes, but is not limited to:

- Fees paid by, or on behalf of, participants at a workshop or conference

- Fees for services performed, such as laboratory tests

- Fees for use or rental of real or personal property acquired under federally-funded projects

- Income from the sale of commodities or items fabricated under an award

- Interest on loans made with award funds

- License fees and royalties on patents and copyrights

Note, however, OMB Uniform Guidance, §200.307 (g) states:

Unless the Federal statute, regulations, or the terms and condition for the Federal award provide otherwise, the non-Federal entity has no obligation to the Federal awarding agency with respect to program income earned from license fees and royalties for copyrighted material, patents, patent applications, trademarks, and inventions produced under a Federal award to which 37 CFR part 401, “Rights to Inventions Made by Nonprofit Organizations and Small Business Firms Under Government Awards, Contracts and Cooperative Agreements” is applicable.

In addition, “Disposition of Rights in Education Awards” (35 U.S.C. 200- 212) applies to inventions made under Federal awards.

B. Allowed Treatment of Program Income

OMB Uniform Guidance §200.307(e) Use of Program income indicates program income shall be retained by the University and, in accordance with Federal awarding agency regulations or terms and conditions of the award, be used in one or more of the ways described below.

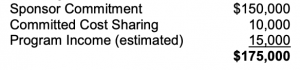

1. Addition Method:

Income is added to the funds committed by the sponsor (and by the University if committed cost sharing is involved), and is used to further eligible project activities or objectives.

Terms of Agreement:

Available for Project Expenses:

For Federal awards made to institutions of higher education (IHEs), such as the UMS, if the Federal awarding agency does not specify in its regulations or the terms and conditions of the Federal award how program income is to be used, the Addition Method must apply.

When a Federal awarding agency authorizes the use of the Addition Method, program income in excess of limits stipulated in the award must be deducted from expenditures.

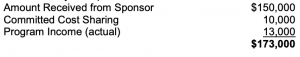

2. Cost Sharing/Matching Method:

Income is used to finance the costs of a project not borne by the sponsor. It is used to fulfill the University’s committed cost sharing requirements.

Terms of Agreement:

![Equation for Terms of Agreement: Sponsor Commitment: ($150,000) + Program Income (estimated) (15,000) + Committed Cost Sharing (maximum) [15,000] = $165,000](https://www.maine.edu/apls/wp-content/uploads/sites/42/2020/07/Screen-Shot-2020-07-27-at-11.27.26-AM-e1595869655406-300x63.png)

Available for Project Expenses:

The Cost Sharing/Matching method may only be used by the University with prior approval of the awarding Federal agency or if specified by the regulations of the awarding agency or the terms and conditions of the Federal award.

When an awarding agency authorizes the use of the Cost Sharing/Matching Method, program income in excess of limits stipulated in the award must be deducted from expenditures.

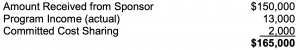

3. Deduction Method:

Income is deducted from the amount of the total allowable project costs to determine the net allowable cost to be reimbursed by the sponsor.

Terms of Agreement:

![Equation for Terms of Agreement: Sponsor Commitment (maximum) $150,000 + Program Income (estimated) [15,000] = $150,000](https://www.maine.edu/apls/wp-content/uploads/sites/42/2020/07/Screen-Shot-2020-07-27-at-1.15.23-PM-300x48.png)

Available for Project Expenses:

The Deduction Method may only be used by the University with prior approval of the awarding Federal agency or if specified by the regulations of the awarding agency or the terms and conditions of the Federal award.

Under the Deduction Method, program income must be used for current costs unless the Federal agency authorizes otherwise. Program income that the University did not anticipate at the time of the Federal award must be used to reduce the Federal award and University contributions rather than to increase the funds committed to the project.

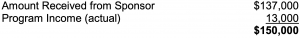

4. Combination of Above Methods:

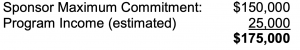

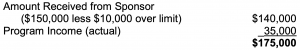

Terms of a Federal award may specify the use of one “or more” of the three treatment methods. Following is an example of combining the Addition Method and the Deduction Method.

Combination Alternative Method: Income received up to a maximum amount specified by the sponsor (e.g. $25,000) is added to the funds obligated by the sponsor and used to further eligible project activities or objectives (e.g. $150,000), for a total of $175,000. After the maximum is reached (e.g. $175,000), the additional income (e.g. $10,000 if actual income was $35,000) is deducted from the amount obligated by the sponsor ($150,000 less $10,000) to determine the amount the sponsor will reimburse, $140,000.

Terms of Agreement:

Available for Project Expenses:

C. Responsibilities

1. University of Maine System Administration:

- Provide an administrative practice letter with guidance on managing program income

- Provide procedures for program income accounting

- Provide guidance in handling income earned after the project is closed

2. Office of Research, or other responsible department:

- Guide Principal Investigator or Project Manager regarding licensing agreements, marketing of inventions, and copyrights. Income earned from license fees and royalties on patents and copyrighted material is not considered program income for Federal awards unless agency regulations or the terms and conditions of the award provide otherwise.

3. Sponsored Programs Office, or other responsible department:

- Advise Principal Investigator or Project Manager on appropriate method(s) for proposing program income

- Review the proposal for anticipated program income to ensure the budget correctly presents program income and sponsor application forms are completed accurately. Facilities and administrative (F&A) costs must be assessed against the program income direct expenses at the same rate as applied to the associated sponsor funds.

- Provide general coordination and guidance, in conjunction with the System Accounting Department, on the proper accounting for program income.

- Report program income as required by the sponsor

- Adjust sponsor invoices to properly account for program income per OMB Uniform Guidance, §200.305 Payment, paragraph (b)

- If program income is to continue beyond the end date of a sponsored project, refer the Principal Investigator or Project Manager to appropriate offices for assistance in recording the additional income.

4. Principal Investigator or Project Manager of a sponsored project:

- Propose the allocation of program income in accordance with guidelines in OMB Uniform Guidance §200.307 Program income

- Identify all program income and ensures such funds are deposited and recorded in accordance with University of Maine System procedures

- Monitor the receipt of program income

- Monitor project expenditure levels to ensure program income is spent first when required by the project sponsor

- Review program income reported to the project sponsor by the Sponsored Programs Office, or other responsible department

- Consult with Department Chair or Dean on the use of program income generated beyond the end date of a sponsored project.

Frequently Asked Questions

- Does the Program Income policy apply to ALL projects?The Program Income policy applies to ALL projects funded in whole or in part with Federal or Federal pass-through funds. It applies to a nonfederally-funded project if the sponsor agreement so requires.

- Is the use of program income subject to audit?Yes. Under OMB Uniform Guidance, Subpart F, a grantee’s program income will be reviewed for compliance with the terms and conditions of award, including allowability of costs, financial management, and reporting.

- How does program income affect the project funding?Unless the sponsor specifically instructs differently, program income generated by research projects increases the project’s funding (addition method).

- When preparing a proposal budget, do I assess F&A costs against program income?Yes, assess F&A costs against program income at the same rate you assess F&A costs against sponsor funds.

- What happens when I have program income remaining at the end of the project’s period of performance?Spend program income before spending sponsor funds. If program income funds remain at the end of the project’s period of performance, they must be returned to the sponsor as unspent funds.

- How do I handle program income earned after the end of the grant period?Unless Federal awarding agency regulations or the terms and conditions of the award provide otherwise, recipients have no obligation to the Federal Government regarding program income earned after the end of the grant period.If the activity generating the program income continues after the grant ends, income and expenses are recorded in a different fund.

- Is income from the sale of property considered “program income”?No, proceeds from the sale of property shall be handled in accordance with the requirements of the Property Standards in OMB Uniform Guidance, §200.311 Real property, §200.313 Equipment, and §200.314 for Supplies, or as specified in Federal statutes, regulations, or the terms and conditions of the Federal award.

- Where can I access NSF (National Science Foundation) requirements related to program income?Click Program Income to link to the Program Income section in the NSF Grant Policy Manual.

- Where can I access NIH (National Institutes of Health) requirements related to program income?Click Program Income to link to the Program Income section in the NIH Grants Policy Statement (11/15).

Related Documents

Accounting for Grants and Contracts – business process document

APL VIII-B Restricted Expendable Funds Guidelines

History of Policy

Issue 1: Effective 04/02/2007

Issue 2: Effective 12/26/2014 (Updated for implementation of OMB Uniform Guidance)

Approved Vice Chancellor for Finance and Administration

Signature on file in the Office of Finance and Administration