Subject: Gift Administration

Issue: 3

Effective: 2/12/07

Guidelines:

The following guidelines are established to help maintain the integrity of gift giving to the University System (see UMS Board of Trustees Policy Manual Section 702, Acceptance of Gifts).

- The Board of Trustees reserves the right to decline any gift which it considers inappropriate, burdensome or contrary to the purpose of the University System charter. Final authority to accept or reject gifts rests with the Board of Trustees.

- The University System may not accept gifts that will interfere with or otherwise restrict academic freedom.

- Gifts accepted must meet the reasonable expectation of supporting the universities in their various missions.

- Gifts accepted must not interfere with established University policies and procedures, and must not interfere with established anti-discrimination policies.

Procedures:

All gifts received by the University of Maine System must be reported to the Board of Trustees for approval as outlined in the Policy and Procedures Manual Section 706 (Acceptance of Gifts, Development Activities & Fund Raising Campaigns). All gifts received by the University of Maine System (UMS) must 1) have any donor restrictions reviewed and approved by the System Office and 2) be recorded on an electronic system for reporting purposes.

1) Approval of the Restrictions of the Donation:

A separate program is established for each gift that carries a unique set of donor specified restrictions. Each program is referred to as a gift fund and has a unique fund description on file with the Clerk of the Board. New gift funds which are inconsistent with the University’s mission or charter, or are not in compliance with state and federal tax regulations or do not meet the guidelines listed above will not be approved.

Fund Description Content:

To establish a new gift program, a new fund description must be prepared that describes the donor’s wishes regarding the use of the funds. The description should clearly state:

- The name of the fund,

- The name of the University, and the affiliated organization (if applicable) for which the gift is intended,

- The year the gift program was established,

- The source of funding for the new program (if applicable),

- Whether or not the funds are to be endowed,

- The purpose of the program and any restrictions that might apply,

- The title of the individual or entity responsible for choosing the recipient(s) if the gift is for an award, prize, scholarship, loan, professorship, etc., and

- The title of the individual or entity who is responsible for administering the program

In addition, if the donor has requested that income be returned to the principal until a designated time or dollar amount has been attained, then that should be clearly stated in the fund description. (See Exhibit I for a sample fund description.)

If the donor requests that unspent endowment earnings be returned to principal at the end of each fiscal year, this request must be in the fund description. Funds returned to principal will become permanently endowed. If there are multiple donors to a fund and it is not possible to obtain signatures from all of them and there is no official representative, the original fund description must include the phrase “. . . at the discretion of the Director of the XYZ Program, and after written approval by the Chief Financial Officer or President of the University of ABC, any unused funds remaining at the end of the fiscal year may be returned to the principal . . .” Written approval will be required on all funds of this type being returned to an affiliated organization. Written approval is also required for any annual in-house additions to endowed principal. The written authorization is required since the return of scarce operating funds by a department head has obvious fiscal implications.

In designating a gift for a specific purpose, donors should be encouraged to describe the purpose as broadly as possible, and to avoid detailed limitations and restrictions. The phrase; “Should it ever become impossible or impractical to carry out the purposes of this fund as described above, an alternative purpose that best fits the donor’s intent and wishes shall be designated by the University President in his/her sole discretion” should be added to the end of fund descriptions whenever possible.

Donor Approval of the Fund Description:

To ensure that all parties agree to the purpose and restrictions of the gift, the fund description shall be approved by the donor, the University president, and the affiliated organization (if applicable).

The responsibility for obtaining approval of the description from the donor shall lie with the University or affiliated organization.

System Office Approval of the Fund Description:

All new fund descriptions must be submitted by University Development Offices to the Office of Finance and Treasurer for approval. These submissions, whether originating at a University or an affiliated organization, shall include applicable pledge statements, wills, and/or other pertinent documentation.

It is not the practice to submit new gift programs for approval unless the donor has already transferred the associated gift to the University or affiliated organization. If there is a compelling reason to approve a new gift program prior to the actual receipt of any gift, then the donor should sign a written pledge outlining a plan for completing the gift, either through periodic gifts or deferred giving. The pledge, or a copy of the irrevocable instrument, should accompany the new fund description. New endowments must be funded with gifts totalling at least $10,000. The principal amount of the original gift need not meet the minimum dollar requirement if the donor agrees to fully fund the endowment at the minimum dollar requirement within a reasonable time period. Minimum endowment requirements will be reviewed periodically to ensure that endowment proceeds are sufficient to fund the intended purpose(s) of the endowments.

The responsibility for submitting fund descriptions to the Office of Finance and Treasurer for approval shall lay with the University President or his/her designee.

Post Approval of the Fund Description:

The Office of Finance and Treasurer will provide the Clerk of the Board with copies of approved fund descriptions.

If appropriate, the University development office should inform the donor or the affiliated organization of the acceptance of the fund description.

2) Gift Processing:

Under the direction of the President, each University shall process and record all gifts on the University’s electronic gift processing system as soon as possible after receipt. The term “processing” is meant to cover all of the necessary receipting, reporting, and documenting connected with the receipt of donations, bequests, devices, and all other gifts. Copies of official documents shall be forwarded to the Office of Finance and Treasurer.

Gifts shall be valued on the date the donor(s) relinquished control of the assets in favor of the University.

Gift acknowledgements shall be processed in a timely manner. If a donor makes a quid pro quo contribution (payment partly as a contribution and partly in consideration for goods or services provided by the University) in excess of $75, the University must provide the donor with a good faith estimate of the value of goods or services provided by the University. If the gift is not quid pro quo, the acknowledgement must include the following statement: No goods or services were provided in exchange for this gift.

Each gift will be credited to a program to be used solely for the purpose specified by the donor (e.g., a gift restricted to UM College of Business scholarships will be credited to the UM College of Business scholarship program; a gift for unrestricted use at USM will be credited to the USM President’s Gift Program to be used solely at the discretion of the USM President).

Unrestricted Gifts:

Unrestricted gifts should be deposited in a gift program with a Fund Code of 00 if they are to be expended during the current fiscal year, or in a gift program with a Fund Code of 10 if their use will extend beyond that period.

Miscellaneous One-time Gifts:

Miscellaneous one-time gifts for specific purposes with no expectation of future gifts for the same purpose may be:

- Deposited into a miscellaneous School, Department, or College support restricted gift program which matches the purpose of the donor;

- Deposited into a Miscellaneous Gift Revenue program with a Fund Code of 00 if it is to be used for a specific purpose within the current fiscal year;

- Deposited into a new restricted gift program created specifically for this purpose with a new fund description approved by the System Office.

In-Kind Gifts:

It is the ultimate responsibility of the donor to provide an estimated value of an in-kind gift, preferably through an appraiser. University personnel with expertise in a given field may estimate values for University purposes only and not for the donor. If the donor values the gift in excess of $5,000 and claims a charitable tax deduction, he/she must file IRS Form 8283 (see Administrative Practice Letter V – C). If the University disposes (sells) the same in-kind gift within three years, the University must file IRS Form 8282 (see Administrative Practice Letter V – C). Proceeds from the sale of in-kind gifts may be deposited in an appropriate gift program provided that detailed documentation is maintained.

Insurance Coverage:

The University Development Office shall alert the Office of Facilities to all in-kind gifts which may require insurance coverage.

Securities Gifts:

Gifts of securities shall be processed in accordance with Administrative Practice Letter V – A, Gifts of Stocks/Bonds.

Charitable Gift Annuities:

Charitable Gift Annuities shall be processed in accordance with Administrative Practice Letter V – D, Charitable Gift Annuities.

Real Estate Gifts:

Gifts of real estate will be processed in accordance with UMS Policy and Procedures 801 (Acquisition of Real Property). As with all other gifts, gifts of real estate must be recorded on the electronic gift processing system.

Gifts vs. Grants:

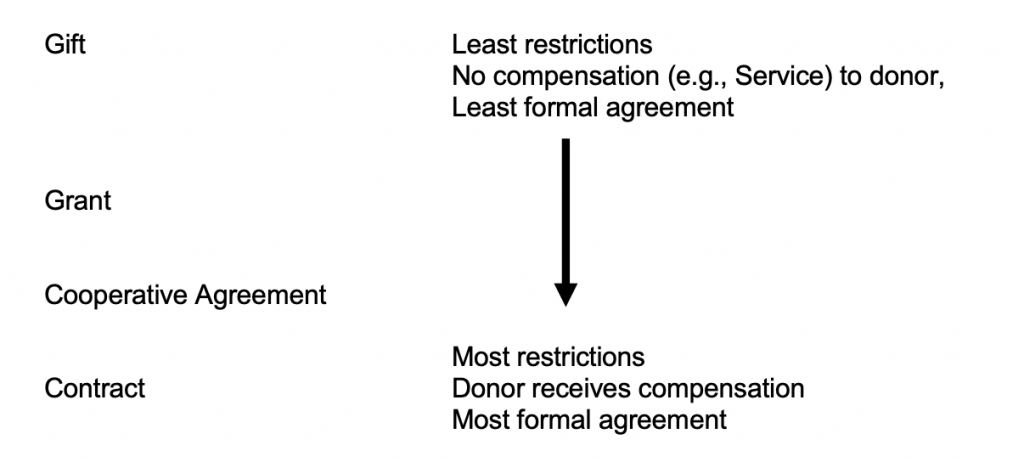

Exhibit II explains the distinction between gifts and grants. In general, gifts are informal with no compensation to the donor and grants usually involve a formal agreement with unexpended funds reverting to the grantor.

Governmental Revenue:

Funds received from governmental entities are generally not considered gifts and should be administered through sponsored programs.

Sponsorships:

Corporate advertising revenue is not a gift and should be processed in the appropriate operating chartfield.

Sales Revenue:

Income from the sale of goods and services is not gift revenue. This revenue should be processed in the appropriate operating chartfield.

Gifts for Capital Projects:

Capital projects may be funded from several sources (e.g., bond issue funds, gift income, University funds). When a capital fund raising campaign will be used to partially or wholly fund a capital project through gift income, the capital fund campaign must adhere to UMS Policy and Procedures 706 (Acceptance of Gifts, Development Activities & Fund Raising Campaigns).

Gift revenue will be deposited in the appropriate gift program after the Board of Trustees has approved the project or after the System has approved the fund description. Reimbursement of capital project expenses will be in the following order:

- Bond issue money

- Gift revenue

- University funds

After all bond issue money is expended, on a monthly basis, the university Office of Facilities will review both the program and the project associated with the capital project and initiate a journal entry with an actual transfer from the gift program to the project associated with the gift program to cover expenses already charged to the project. The actual transfer will not be for an amount greater than the balance in the gift program.

Expenses associated with fund raising or donor recognition for the project (e.g., non-architectural graphic materials, dinners) are NOT considered project expenses. Fund raising expenses should NOT be charged to the project program unless they are specifically addressed in the Board of Trustees project or System approved fund description or authorized in writing from the donor.

Gift programs will be inactivated only after all pledges are paid-in-full, cancelled or written-off.

Board of Trustees’ Gift Reports:

The Office of Finance and Treasurer shall prepare an annual summary of gifts and fund raising for approval by the Board of Trustees. This report will be generated from the University’s electronic gift processing system. Each University must ensure that the necessary gift information is electronically available. Necessary items include the date of the gift; the donor name; the donor source (e.g., alumni, corporation, foundation); the program the gift is credited to and whether the program is unrestricted, restricted or endowed; the gift amount; and a description of the gift if it is in-kind. The summary gift report presented to the Board of Trustees will include gift totals by university, by source, and by restriction type.

Administration of Gift Programs:

Administration of gift programs includes monitoring expenditures to ensure strict compliance with the approved fund description. Once gifts are accepted, the University has a fiduciary duty to see that gifts are utilized as specified by the original donor. It is incumbent upon the Universities to administer gift funds in a prudent and efficient manner.

Reasonable and prudent management fees may be charged to endowment programs per Policy 706 (Acceptance of Gifts, Development Activities & Fund Raising Campaigns). This fee may be allocated to the universities at the discretion of each University President. If a University chooses to deduct this fee, it will be deducted directly from each individual program endowment earnings allocation on a monthly basis.

Reconciliation:

A necessary step in controlling the processing of gifts using automated systems is reconciliation. On a monthly basis the University Development Office should reconcile the gifts received and posted to the electronic gift processing system with the gifts recorded in the financial accounting system. It is imperative that all gifts be routed through the University Development Office prior to being deposited at the Business Office in order to fully utilize the gift processing system and provide for reconciliation. Failure to reconcile between the two systems could result in gifts being received and not deposited on a timely basis, gifts being received and recorded in the accounting system (cash deposited) but not reflected in the development system which could result in failure to communicate appropriately with the donor, or gifts being deposited in the wrong programs.

The above reconciliation should be sent to the Office of Finance and Treasurer on a semiannual basis (following the December 31 and June 30 reconciliations). Detailed information on the reconciliation process can be found in Exhibit III.

Affiliated Support Groups:

A President may recognize as an affiliated support group any independent organization whose only purpose is to raise funds and provide financial or other support for the activities of a University institution or unit (see UMS Policy and Procedures 706, Acceptance of Gifts, Development Activities & Fund Raising Campaigns).

An affiliated support group may be authorized by the President to use the name, seal, or logo of the University System entity involved, by the President and at the President’s discretion, to use space, equipment, and staff support in the performance of its support activities. No independent group, not so recognized, which purports to raise funds or otherwise provide support for University programs may expressly or by implication use the name, seal, or logo of the University of Maine System, or the name, seal, or logo of any of its institutions or units, facilities, sports teams, or programs (see UMS Policy and Procedures 208, Logos and Trademarks; Administrative Practice Letter IV – C, Signature Authority).

A President may designate an affiliated foundation as a support group active in raising and investing funds from the public at large for the benefit of the entity. An affiliated foundation must operate under by-laws. Affiliated foundations (including its officers, employees, and agents, if any) shall act solely in the capacity of an independent contractor and not as an agent for the University. Affiliated foundations will consult with the University of Maine System Board of Trustees where matters of public interest and concern arise in connection with investment policies. The income from endowed gifts accepted by an affiliated organization for the University of Maine System will be used exclusively for purposes specified by the donors.

To assure public confidence in all aspects of University fund raising, the records of affiliated foundations may be examined in the regular University System audit. Pursuant to GASB 39, the University of Maine Foundation and the University of Maine Pulp & Paper foundation audited financial statements are included in the System audited financial statements. Periodic assessments will be made as to whether other university affiliated foundations will be included. Affiliated organizations are required to submit, in a timely manner, annual financial statements; audited, reviewed or compiled by an Independent accounting firm, and a copy of IRS Form 990 (Return of Organization Exempt from Income Tax) as available.

Miscellaneous:

Legal Fees:

Legal fees involved in processing gifts will not normally be absorbed from gift funds. The University to which the funds are credited will be charged for any legal services incurred in processing the gift.

Annual Unspent Gift Earnings:

The University will generally not return earnings to principal or to affiliated organizations unless the fund description so specifies. This policy honors the intent of the donor. In addition, the unspent earnings will be credited with temporary investment income so that the funds available will grow.

If the terms of the endowment are so restrictive that spending the earnings is not likely, the applicable campus needs to contact and work with the donor to have the fund description rewritten. If this is not possible, legal steps should be taken to alter the fund description.

On the very rare occasion that the campus determines that moving earnings to the endowment is appropriate, the Chief Financial Officer or President must approve this request and forward it to the Office of Finance and Treasurer. The request must include:

- Why the recommendation to move the funds is being made.

- What steps the campus has taken to spend the funds.

- A summary of correspondence with the donor regarding loosening fund restrictions or why such action is not considered necessary.

- Any other relevant information.

Only then will the System Office direct the earnings to a new quasi endowment account. As a quasi endowment, the monies will accumulate; however, they will be available for spending at some future point.

Record Retention:

Alumni Data and gift records are to be retained for a period of years as specified in Administrative Practice Letter IV – D, Record Retention Practices.

Campaigns: Capital and annual fund raising campaigns must adhere to UMS Policy and Procedures 706 9Acceptance of Gifts, Development Activities & Fund Raising Campaigns0.

Presidents’ Gift Programs:

Presidents in the University of Maine System exercise wide discretion in discharging their daily responsibilities. Responsible for academic integrity, selection of faculty and staff, and for sound financial operation, Presidents must be able to exercise their judgment on a variety of issues without excessive constraint. Among their principal responsibilities are decisions on budget and financial matters. Well-established procedures govern the budget-making process, procurement and payroll administration. Gift programs, however, present a special case.

The basic principle of gift administration derives from the law of trusts: the donor’s wishes must be strictly observed, restricted gifts are used only for the purpose stated. Many gifts, however, are unrestricted as to purpose but are designated for the use of a particular University. These gifts are placed in an interest-bearing program known as the Presidents’ Gift Program. These gifts cannot be used for the personal enrichment of those controlling them, or their families; nor be used to circumvent salary administration, nor for partisan political contributions, nor for any illegal purpose. Within these limits, Presidents are free to use unrestricted gift funds for any University purpose.

APPROVED: Vice Chancellor for Finance and Administration

Exhibit I – University of Maine System Gift Administration Fund Description

The following paragraph should be used as a guideline when developing new fund descriptions to be submitted for approval. All items are mandatory unless otherwise specified.

The (Program Name – A) was established (Name of University or Foundation for the University – B) in (Year – C) (With a Gift from Donor – D)(E). The (Fund/Income from the Fund – F) shall be used (Purpose of the Fund/Restrictions – G). (Selection of Recipients – H). The fund shall be administered by the (Title/Office – I). (Should it ever become impossible or impractical to carry out the purposes of this fund as described above, an alternative purpose that best fits the donor’s intent an wishes shall be designated by the President of the Name of The University in his/her sole discretion – J.)

A – Enter the Program Name here.

B – Enter the name of the University establishing the program or the name of the Foundation where the program was established and the University for which it was established using the following examples:

- at the University of Maine

- at the University of Maine at Augusta

- at the University of Maine at Farmington

- at the University of Maine at Fort Kent

- at the University of Maine at Machias

- at the University of Maine at Presque Isle

- at the University of Southern Maine

- in the University of Maine System

- in the University of Maine Foundation for the University of Maine

- in the Foundation of the University at Presque Isle for the University of Maine at Presque Isle

- at the University of Maine at Farmington on behalf of the University of Maine at Farmington Alumni Foundation

C – Enter the Year in which the program was, or is to be created:

- 2005

- 2006

- 2007

- 20..

D – Optional: Enter the major source of funding here. This indicates whether the gift is from Other Non-Profit, Businesses, Students, Individuals, Investments, Multiple Sources or Other Sources. Examples include:

- with gifts from family and friends

- with a bequest from …

- with a gift from the estate of …

- with a gift from (NAME OF COMPANY/BUSINESS/SOCIETY/ GOVERNMENT/INDIVIDUAL)

- by memorial gifts from family, friends and associates

- by the family of …

E – Optional:

Enter the person in whose memory/honor the gift was created for:

- to honor …

- in memory of …

F –

- Fund shall be used if the program is to be a restricted program funded by non-endowed gifts.

- Income from the Fund shall be used if the program is to be an endowed program (this includes programs set up for the University affiliated foundations investing in the University’s pooled endowment fund).

G – State the purpose of the program and any restrictions that might apply here. Examples of purposes might include but are not limited to:

- support the … library

- provide scholarship assistance to …

- to make an annual award to …

- or the support of …

- to support research in …

- for the promotion of …

H – If the program is to be a scholarship, award, prize, loan or professorship the entity responsible for selecting the recipient should be entered here using the following wording:

Selection of the recipient(s) shall be made by (Office/Department/Position Title/Other)

Do not enter the name of a specific person.

I – Enter the office, department or position title of the person responsible for administering the fund. Generally if the program is to be a scholarship, award, prize, or loan the Office of Student Aid will be responsible for administering the fund. Do not enter the name of a specific person.

J – Optional: Include this statement whenever possible to avoid potential future legal issues.

Exhibit II

Definition

The University of Maine System receives funds from various individuals, organizations, and agencies. These funds are provided to the University with differing levels of restrictions as to how the funds are to be used, differing requirements for what will be provided to the donor in return for providing the funds, and differing levels of formality regarding the agreement between the University and the donor of the funds. The following chart shows the various types of funds that are provided to the University and the differences between them.

The following are the distinguishing characteristics of the various types of funds.

Gifts

A gift is a voluntary transfer of cash or tangible property. There is no expectation of any tangible compensation to the donor such as exclusive use of a final report. Gifts are awards with few or no restrictions specified, and tend to be rather informal.

Grants

Like a gift, a grant is bestowed voluntarily with no expectation of any tangible compensation to the grantor. A grant represents a mutual joining of interests in the pursuit of a common objective. There is no substantial involvement between the grantor and the grantee in the performance of the activities supported by the grant. Grants tend to involve a formal agreement between the parties that is more lengthy and restrictive than for gifts but is more flexible than cooperative agreements or contracts. A grant does not constitute the procurement of goods or services by the grantor. Any unexpended funds usually revert to the grantor.

Cooperative Agreements

A cooperative agreement involves a more detailed specification of the conditions and expected results of the award. Substantial involvement is anticipated between the sponsor and the recipient during performance of the activity. This involvement may include directed performance, exchange of employees, frequent reporting, exchange of materials and test results, and specification of performance results.

Contracts

A contract is a written agreement, often negotiated, between the institution and the organization providing the funds and is enforceable by law. A contract generally involves the generation of a tangible product or service often for the exclusive or proprietary use of the contracting agency and is subject to certain standards of performance and the expectation of economic benefit on the part of the contracting agency. Contracts usually require frequent, detailed reporting. They often involve lengthy bidding procedures, competitive negotiations, and detailed pricing information prior to award.

Gift Processing Procedures

Gifts to the University of Maine System can be categorized as follows depending on the wishes of the donor.

- Unrestricted

- Restricted

- Plant

- Loan

- Endowment

- Quasi-Endowment

- Term Endowment

- Separately Invested

Unrestricted

Unrestricted gifts are those given without any restrictions as to use. In cases where the donor expresses a preference but leaves the decisions as to use to the institution, the gift is treated as unrestricted. Unrestricted gift funds may be expended at any time and prior to expenditure earn interest income as part of the temporary cash investment portfolio.

Restricted

Gifts to be used for purposes as specified by the donors are Restricted Funds. These funds, including principal, may be expended at any time and prior to expenditure earn interest income as part of the temporary cash investment portfolio.

Plant

These are funds to be used for specific capital projects such as new buildings or building renovations as specified by the donors. These funds, including principal, may be expended at any time and prior to expenditure earn interest income as part of the temporary cash investment portfolio.

Loan

Gifts to be used to make loans to students as specified by the donors are Loan funds. These funds, including principal, may be loaned at any time and prior to being loaned earn interest income as part of the temporary cash investment portfolio.

Endowment

These are gifts given by donors to be invested in the University’s pooled endowment fund. Such gifts have the donor stipulation that the principal not be expended, and that the income be unrestricted as to use or used for specific purposes. When the income is restricted as to use, the income is applied to a restricted account established for that purpose. When the income is not restricted as to use, the income is generally applied to an unrestricted or designated account. In order for a fund to be endowed it must have a book value of at least $10,000.

The University’s pooled endowment fund offers the advantages of broad diversification with attendant protection of principal and relative stability of income. It also permits economies in administration and accounting.

The University uses the unit method for allocating endowment value to gift funds held in the endowment pool. Each year an income objective for the pool is determined and that income is paid out to each income account in proportion to the number of units held. If there should be unexpended funds in an income account, the funds remain in the account and earn interest at the current rate, unless the donor has specified that unused income be added to principal.

Quasi-Endowment

Sometimes gifts are given with or without any restrictions as to use, and without stipulation that the principal must be kept intact. If the Board of Trustees elects to invest the fund and expend only the income, the fund is a quasi-endowment fund.

Term Endowment

Term Endowment funds are gifts given with or without any restrictions as to use. If the Board of Trustees or the donor stipulates that the fund is to be endowed and the principal kept intact until a specified event occurs or the passage of a stated period of time, the fund is a term endowment fund.

Separately Invested Endowment

These are gifts given with or without any restriction as to use. If the Board of Trustees or the donor stipulates that the principal not be expended and that the fund be invested separately and not commingled with the pooled endowment fund, expending only income, the fund is separately invested. The income from separately invested funds accrues directly to the fund or the income account as stipulated by the donor or the Trustees.

The University encourages donors to consider the advantages of applying their gifts to the pooled endowment fund as opposed to being separately invested.

Exhibit III – University of Maine System Gift Administration PeopleSoft and BENEFACTOR Gift Reconciliation

A necessary step in controlling the processing of gift receipts using automated systems is reconciliation. On a monthly basis the campus Business Office should reconcile the gifts received and posted to the University’s electronic gift processing system with the gifts recorded in PeopleSoft (PS). It is imperative that all gifts be routed through the university Development Office prior to being deposited at the Business Office in order to fully utilize the BENEFACTOR system and provide for reconciliation. Failure to reconcile between the two systems could result in gifts being received and not deposited on a timely basis, gifts being received and recorded in the accounting system (cash deposited) but not reflected in the development system which could result in failure to communicate appropriately with the donor or gifts being deposited in the wrong programs.

In order to streamline gift processing, Electronic Systems exist which (1) automatically feed payroll deducted gifts to the University from the payroll system to BENEFACTOR and (2) feed gifts to PS which have been posted to BENEFACTOR. These systems reduce the number of data entry steps and improve the accuracy and timeliness of data entry.

Automatic Payroll Feed to BENEFACTOR

The automatic feed to BENEFACTOR from PS of payroll deducted gifts to the University System occurs each time payroll is run. All payroll deducted gifts are deposited in a university specific PS general ledger payroll gift clearing account (25003). The information associated with the gifts (i.e., donors name, amounts etc.) is electronically fed to the BENEFACTOR System. The university Development Office is then responsible for initiating the BENEFACTOR POST TX Trans/Generate JV’s (POST) process. Initiating the POST process automatically feeds the information to PS, creating a journal entry which credits each gift program with the associated gifts and debits the payroll gift clearing account (batch ID format BJCXXX).

Automatic BENEFACTOR Feed to PeopleSoft

The Development Office deposits on a daily basis all gifts to the general ledger non-payroll gift clearing account (25002) at the Business Office after entering the gift information on to BENEFACTOR. The automatic feed to PS from BENEFACTOR of non-payroll deducted gifts occurs as the BENEFACTOR POST TX Trans/Generate JV’s (POST) process is run. The feed creates a journal entry (batch ID format BJCXXX) which credits the appropriate gift program and debits the university specific general ledger non-payroll gift clearing account (25002).

Reconciliaton

The reconciliation process involves two basic steps: (1) the payroll and non-payroll gift clearing accounts in PS should have zero balances, and (2) the gifts recorded in PS and BENEFACTOR should be equal.

- PS Payroll and Non-Payroll Gift Clearing Accounts Should Have a Zero Balance.(a) Payroll Gift Clearing Account When gifts are deducted from employees’ paychecks, the funds are automatically placed in the PS payroll gift clearing account. These funds are distributed to the appropriate PS gift programs and removed from the payroll gift clearing account by running BENEFACTOR gift processes. At the end of the process the account should have a zero balance. If at the end of the month the balance is not zero in the payroll gift clearing account, then the transactions responsible for the non-zero balance must be itemized and corrective action taken.

(b) Non-Payroll Gift Clearing Account On a daily basis the Development Office deposits gifts at the Business Office in the PS non-payroll gift clearing account. These funds are distributed to the appropriate PS gift programs and removed from the non-payroll gift clearing account by running BENEFACTOR gift processes. At month end the balance in the non-payroll gift clearing account should be zero. If the balance is not zero, then the transactions responsible for the non-zero balance must be itemized and corrective action taken. - The Gifts Recorded in PS and BENEFACTOR should be Equal.At the end of each month a comparison should be made of the gifts recorded in PS and BENEFACTOR. The fiscal year-to-date gifts recorded in PS should equal the fiscal year-to-date gifts recorded in BENEFACTOR on a program by program basis. In order to assist in doing this comparison two computer programs have been written:(a) BENEFACTOR program which lists fiscal year-to-date or current month gift totals by designation.

(b) PS program which lists current month and fiscal year-to-date gift totals by program and compares them to the current month or fiscal year-to-date gift totals by designation for all gift accounts in BENEFACTOR and prints the difference between the two totals. If there are programs that show different gift totals, then the transactions responsible for the variances must be itemized and corrective action taken as appropriate. To assist in identifying the transactions responsible for any variances, two other computer programs may be run.

(c) BENEFACTOR program that lists all gifts given to a single designation.

(d) PS GL Inquiry transaction display for a single account.

The above reconciliation processes should be done on a monthly basis and a copy of the reconciliation should be sent to the Office of Finance and Treasurer on a semiannual basis (following the December 31 and June 30 reconciliations). The attached form might serve as a useful format for documenting the reconciliation. This form should be completed for each PS/BENEFACTOR program/designation that isn’t equal and for each PS gift or payroll clearing account that does not have a zero balance at month end.

For questions or concerns accesses the above form, please call 207-581-5846.